Playlists Manage

Log in to create a playlist or see your existing playlists.

Log inHow to go through the complete opening flow including reconciliation in Business Central?

When you’re all set to do the complete final postings on your go-live in your Business Central, I would suggest that you make a copy of the company and make sure everything is correct by running through the complete flow.

This is what happens in the video

In this video, I’ll run through everything on my complete flow.

I’ve prepared everything, I’m ready to go live, I made a copy of my company, I’ll go into my chart of accounts, just to make sure, that nobody posted anything.

So, we don’t have any entries here, I might also check my item ledger entries and VAT entries, bank entries etc.

So, everything is clean and we’re ready.

I’m about to test that everything is correct.

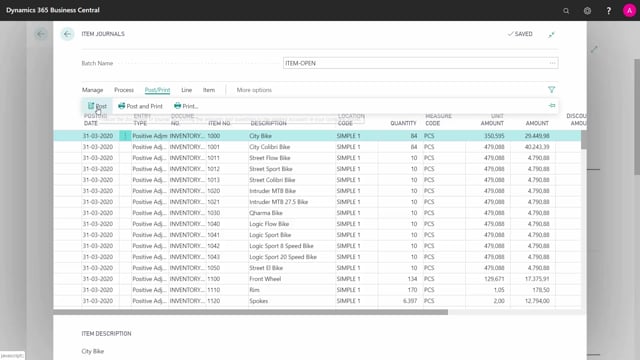

I would go into my item journal, and I’ve prepared an order for this.

In my item journal, I’ve already created my opening.

I’ve done that in all of my journals.

I just need to post them.

I will post my item journal.

I’ll suggest, that you might want to delete your opening journals, when you’re done, so you don’t have a lot of journals, you won’t need.

Here is my item journal, I can filter on my NET change, if I want to follow what I’m doing.

I can filter on that, being different from zero, I now see, that my item journal made a lot of stuff here, as expected.

I can go into my general journals and post all my different journals here.

I will start, let’s just take them one by one, my bank opening, post it to create the bank entries.

It resets the chart of accounts, my customer openings.

I’ve tested all those separately, before doing this exercise.

This will make the chart of accounts go back to zero, therefore I would also ignore my G/L balance, just to check it, I’ll post my inventory things to reset my inventory, I’ll post my VAT opening.

And I will reverse my reverse charts, so it will go back to zero.

And I’ll just need to post my vendor.

The only thing I haven’t posted, is the opening balance, I’ve posted all my different entries, I could check all the different entries everywhere, to see that it’s correct.

And I can check, that my chart of accounts go to zero so I’m happy, as for now.

I’ll post my final journal, my general journal, my opening journal.

Everything is now posted.

You can see all my different balances and I’ll start by reconciling my items in my inventory value list on that opening date.

And I can preview that and save it somewhere on the screen, if I want to see it and don’t remember all the figures.

In this scenario, I’ll just remember the figures 135,000 on my finished goods, my raw materials, having 116,000, my resell 129,630, my semifinished goods is 37,000 and my total of 419,000.

So, this is all my opening on the inventory, I can control them with the lines up here, and they seem to fit correctly.

Likewise, I would like to reconcile.

And the reason of reconciling my customers and vendors, and the reason I’m doing all this, is because the opening journal is entered manually.

I could have entered whatever numbers I wanted to, so I would like to check that everything is correct.

I will use the report for reconciling, I can see that my my customer ledger entry and my G/L entry on the customers equals and there’s no difference.

So that’s nice.

I could look at my bank accounts to reconcile those.

I’ll just take my first bank account and navigate into my balance.

And I can see, that the balance from the bank account ledger entry should be 2,296,344 and on the second bank, if I’m looking at that as well, I see it should be 135,000 in the local currency, 274, and I can see that these amounts, should fit to my bank accounts, which they do.

And the last thing is my VAT, I would like to reconcile and I’ll do that from my VAT statement.

And in my VAT statement, I have my preview, so I can preview all my open VAT entries, I can see my sales VAT should be 30,366, my acquisition tax 126.

84 and my total purchase, my deductions 8,125 and I can reconcile those figures into my chart of accounts, in the VAT section.

So, everything is correct and I can open my Business Central and start working.