How to create opening entries for VAT in Business Central?

Often we see that when customers go live in a new Business Central solutions, they will settle on the VAT in the old system to avoid opening VAT entries in the new system.

This is what happens in the video

But sometimes it’s not possible and you would like to have open VAT entries imported in your new system.

I’ll show you how to do that, to create VAT entries, and still to zero out the chart of accounts, so you can do a full opening balance later.

First of all, let’s look into the chart of accounts in here.

Just to see that in this scenario, we have no entries in the system until now whatsoever.

And I’ll post my VAT entries from a general journal, in here.

So I’ll just enter the VAT, more or less directly, but before I’m doing that, I want to tell you what the scenario is.

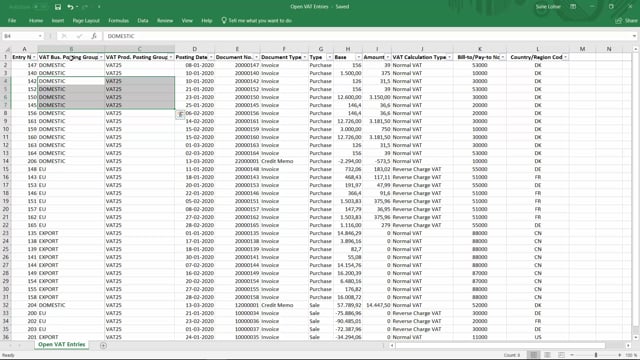

So let’s look into Excel.

Here we are.

So these are my open VAT entries from the old system.

And what I’m going to report, when I settle my VAT, is the combination of my VAT business posting group and VAT product posting group.

And basically, I could just collapse all the entries with the same combination, if I want to, instead of making all those entries here, so I could just take the base amount and all those ones and collapse to one base amount and it should calculate, of course, automatically the VAT amount for me.

Back in Business Central, I will enter here my journal for my document number, VAT open for instance, A nd I’ll select my VAT sales account number, if it’s the sales VAT I’m entering first.

I need to find that account and I can find that in the VAT posting setup.

And while I’m in here, I could just explain you a conflict, in here, we have to handle afterwards.

So here’s my combination of VAT business posting group and VAT product posting group.

And I can see here in my sales account and my purchase account.

And what I have to be aware of is the combination of EU and VAT 25.

for example, we have the reverse charts account, being another account, than my sales and purchase account.

That will create a deviation, we have to handle later on.

But these are my two accounts that, I have to use.

So on my journal, I will enter my sales VAT account, like this.

Just insert the line.

Here we are.

And then I will enter my general posting type, being sale, because its sales VAT, I’m going to post here, my VAT amount and which is the base amount on the open entry.

And if you don’t have the base amount, you’ll just have to calculate it from the VAT amount.

So if it’s a VAT 25%, you’ll have to multiply it by five, if it’s 12.

5% you have to multiply it by 10 as an example, that’s a little calculation, you can enjoy yourself with.

Here in my balance account is the same account.

So I would like the G/L balance to go into zero, while creating those VAT entries, because I would like to open the balance later on, with one big journal.

Now the remaining thing, I need to do, is on the right hand side in my general journal, I need to enter my VAT business posting group and my VAT product posting group, in here.

And this will automatically calculate my VAT amount.

Now I’ve done this, for all the lines of course, I have cheated a little.

So if I enter my journal here VAT opening, I can see that I’ve made entries of sales and purchase, on two different accounts, my sales VAT account by purchase VAT account, a nd if I scroll right, I have all the amounts here, be aware here, that my combination of for instance, export and VAT 25 has a VAT amount of zero, because there’s no amount, but I still like the open entry, because I have to settle all of my revenue, creating VAT.

And likewise here on my EU and VAT 25, I know that this line is going to create reverse charge posting and I have to handle those afterwards.

But in here, I just need to open them for now.

Meaning, I will post this journal like this.

When I go back now into my chart of accounts, I can see that it has created entries in here, and all the entries are on my VAT accounts, of course, but if I filter on my NET change here, being different from zero, I can see that it actually made this acquisition text, that I have been talking about, from my reverse charge.

And I like to zero those out, so I can create a clean opening balance later on.

Therefore, I will go into my general journal again, and I’ll just manually post this amount, from one account to the other.

When you’re preparing you’re go-live, you could just create journals for this, as I’ve done here, so it’s already created here and you’re ready to do a full posting, when you get to the actual go-live.

So it’s in here I can just post this one like this, and now my scenario is, that my chart of accounts is zero, all the way through, and if I look into my VAT entries in here, I can see that it created all my VAT entries, as open entries, that I’d like to settle later on.