How do you manage jobs in different currencies?

Let’s have a look at how you can handle jobs and a currency other than your local currency.

This is what happens in the video

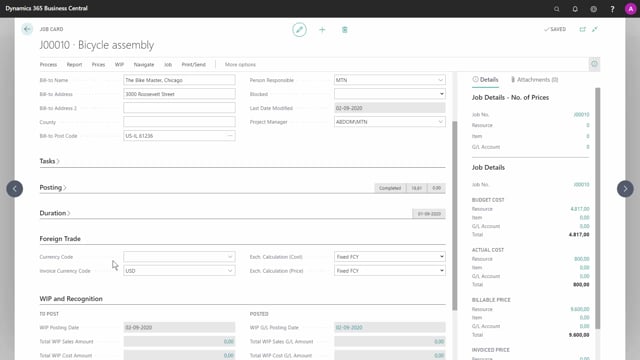

I have an open job card here, and under the tab foreign trade, we have four fields. We have the currency code, and the invoice currency code and both of these will be blank If we’re using our local currency.

The currency code field will by default be blank on your job. If you insert foreign currency code here; the whole job with planning and invoicing will be handled in that currency.

Be aware that you cannot change this currency code after you’ve started posting entries to the job.

The invoice currency code here is set to US Dollars and that comes from the set up on the customer because it’s a US customer.

So, in this setup, we will handle the job itself in our local currency, but the customer will be invoiced in US dollars from this job. And that’s quite a normal setup.

So, we make sure the customers are invoiced in the correct currency.

To the right we have two fields regarding exchange rate calculation, both for cost and for price, in both fields we have the option fixed FCY and fixed LCY.

F is for foreign, and L is for the local, so fixed foreign currency, and fixed local currency. These fields are really good to have because they determine how we handle changes in exchange rates.

The exchange calculation for cost specifies how job costs are calculated, this will happen if you change the currency date, but the currency code fields on a job planning line, or if you run the change job planning line date batch job.

If you here choose the fixed LCY option, but job costs in the local currency will be fixed.

So, any change in the exchange rate, will change the value of job costs in the foreign currency, on the other hand If you choose fixed FCY, the job cost in foreign currency will be kept fixed.

And then you change in the currency exchange rate, will change the value of job costs in the local currency, and the same goes for the price.

This specifies how job sales prices are calculated, if you change the currency date, or the currency code fields on the planning line.

And again, if you run the change job planning line dates batch job, and this can affect the invoice you sent to your customer, of course.

So if you have agreed on a price of $1,000, you would want to keep your setup as fixed FCY, because then the amount of $1,000 will be kept unchanged, and then you change of the exchange rate, will change the value of job prices in the local currency.

If you on the other hand want to keep the local currency fixed and choose fixed LCY option, then the job price in the local currency will be fixed, and any change in currency exchange rate will change the value of job prices in the foreign currency.

I have a short overview of this, the fixed local currency option means that if the exchange rate changes the amount LCY field will stay constant, but the amount field will change in accordance with the exchange rate.

If you choose the fixed foreign currency option, the amount LCY field will change in accordance with the exchange rate.

But the amount stays constant.

Like the example I told about, where we set the exchange rate for price to be fixed foreign currency, to make sure that the agreed amount is constant.

So, for example, the $1,000 we have agreed with the customer, it’s also what we will be invoicing.