How to control the Vendors VAT Registration Number format in Business Central?

In this video, I will go through the validation of the VAT registration number when you enter it in the field on the vendor.

This is what happens in the video

So here I have a Danish vendor and I will enter a VAT registration number and it returns to us an error because the VAT registration number does not meet the format that I have planned.

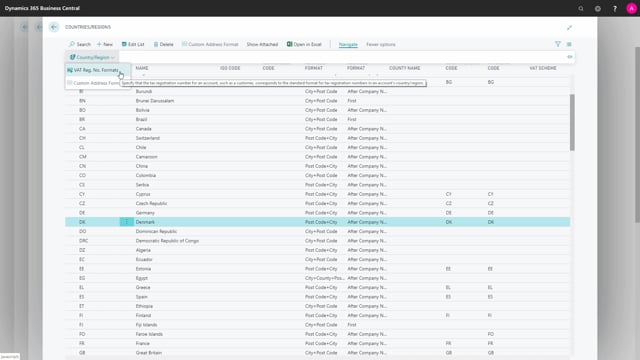

So what I need to do is I need to go to the country region code list.

And as it was a Danish vendor, I need to find Denmark and I find Denmark here. So under the navigate, the country region, I have the VAT registration number formats.

So in here, you can see the list of the valid formats that’s allowed in Denmark. So that would be DK and eight numbers, just eight numbers, DK and eight numbers in pairs of two, or just numbers in pairs of two.

So only these formats fulfill the requirement of the Danish government. If I don’t want any validation on the format on my VAT registration numbers, I just delete the values in this table.