How to control the Vendor's VAT Registration Number with the EU Number Validation Service in Business Central?

In this video, I will go through how to control the vendor’s VAT registration number with the EU VAT registration number validation service.

This is what happens in the video

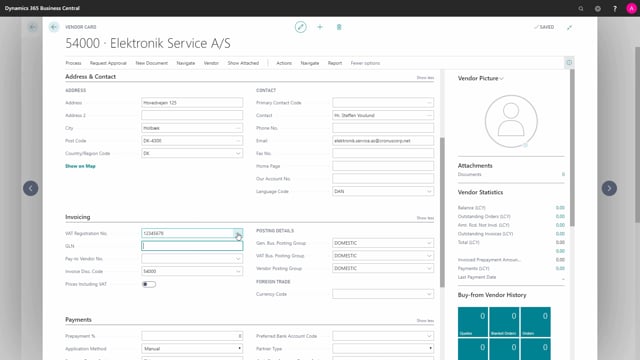

So I want to enter a VAT registration number and that could be like this and it tells me we didn’t find a match for this number and please verify you entered the correct number. Okay.

And what happens is if I look in my setup, I can see I have something that is not verified.

So if I look in this setup, I can see I have something that is not verified or something that is, in this case, invalid. I just close and that’s because I have a setup that enables me to validate the VAT registration number within the European Union.

So I go to the EU VAT registration number validation set up and I can see right here it is enabled and that’s why it asks. And I have the home page where this service endpoint is.

So this is a standard set up in Business Central and you can enable or you can disable it. The genius thing about this is that you can confirm that the VAT registration number you get from your vendor is, in fact, a valid VAT registration number and you will get all times the correct name and address on your vendor card.