Playlists Manage

Log in to create a playlist or see your existing playlists.

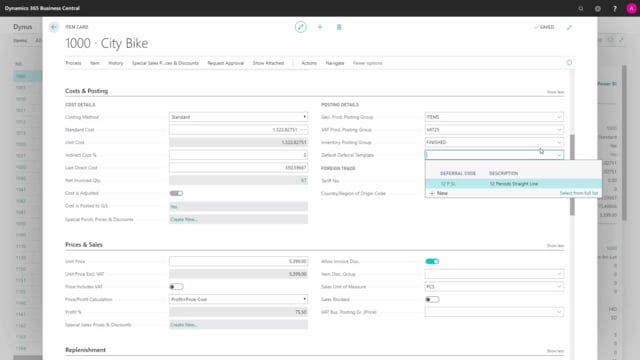

Log inHow to use item fields for the finance department in Business Central?

On the item card in Business Central, there’s some fields relevant for the finance department. That’s the custom posting tab here, and I would just run through the field shortly to explain what they mean and what they do.

This is what happens in the video

First of all, the costing method is set up when you create the item That’s the way of handling the cost on inventory for this item of course.

The standard cost is normally calculated, if it’s a production or an assembly item you can calculate it from its bill of materials, but it’s also possible to enter manually and it’s set up normally for items with variants, that you would like to use and handle the variances separately.

Unit cost, is the cost the item is handled on in the inventory so the unit cost reflects the amount on inventory and it comes from the standard cost if the costing method is standard and it comes from the average cost, if it’s FIFO or average etc.

So, we have separate videos explaining how this cost is calculated.

The indirect cost percentage is set up if you want to add cost to the last direct cost if you want FIFO on inventory, or you understand that and you want to add some costing percentage on your inventory for items that could be from handling, so item charges that you don’t post through the item charges functionality.

So, it’s a way of raising the cost, if you have other cost to the item that you would like to be reflected on the inventory.

Last direct cost is the last direct purchased cost or manufacturers cost on the item that is automatically calculated and entered here on the item card.

The NET invoiced quantity, is the quantity on inventory that is invoiced, meaning it defers from the inventory fields, if we go up here.

The quantity on inventory here, I can see it’s 87.

The NET invoiced quantity is, 67, meaning that we have 10 pieces that is either received or shipped that hasn’t been invoiced yet.

The checkmark for cost is adjusted, is displaying whether all the entries for this item has been adjusted with the cost adjusting batch job or if it’s set up automatically to adjust the cost, so this means the item ledger entry, has been adjusted with the correct cost after all the postings and after the adjust cost item entries batch job has run and all the item entries are adjusted, it’s possible to post these costs into all the corrections into the G/L, and if the cost is posted into the G/L it says yes here so this is just displaying whether or not the GL is updated with the actual inventory cost from the item ledger entries.

Special prices are normally used for purchase and salespeople actually this is for the salespeople and it creates special sale prices.

The posting group is set up, when you create the item the general product posting group determines where the cost of this item goes into the income statement.

The V.A.T of course, and it’s normally filled out from the field in from the general posting group, the V.A.T posting group determines, of course, the standard V.A.T for this item, and it works together with the V.A.T setup from customers or vendors when you create order lines and the inventory posting group determines, where in the balance the cost of this item is entered, so this is the way of handling, where you see the item cost and the revenue or purchases on this item in your chart of accounts.

You can set up a default deferral template, and if you set that up when you have purchase or sold this item, it’s possible to actually make it deferral automatically and you can see how deferrals are working, in a video on deferrals.

If you have to report into the Intrastat.

You could also define tariff number here and country/region code, which is some of the field, you need to set up when reporting Intrastat.

So, this is the fields on items relevant for the finance department.