How to control the Customers VAT Registration Number with the EU Number Validation Service in Business Central?

In this video, I will go through the EU VAT registration number validation service when entering a VAT registration number on a customer.

This is what happens in the video

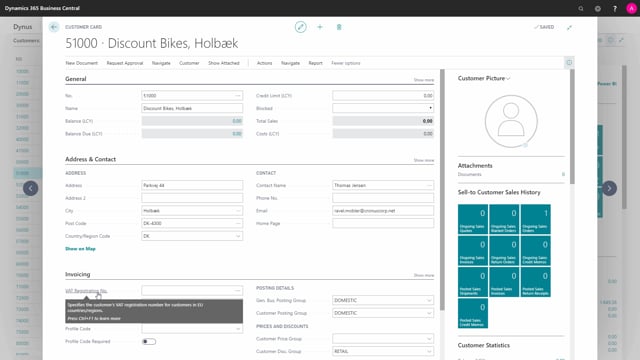

So I will just enter a number on this customer and that’s a valid format for Denmark where my customer is placed and it tells me that it didn’t find a match for this number and the match is actually on the EU VAT registration number validation database.

I’ll press OK and I will just look upon this one here whereas I have a table where I have a lot of invalid or not verified VAT registration numbers.

So I would go to the EU VAT registration number validation service setup and we have it right here and you can see it’s a standard setup. It has a homepage where it controls all the VAT numbers and I can enable or I can disable it. It’s standard setup as enabled.

The smart thing about this service is that if you enter a valid VAT registration number for a company that you got from your customer, actually it will test on the name and address on your customer and it will correct it in Business Central if you allow it to do that.