How do you create deferrals on journals or sales and purchase documents in Business Central?

When you have set up deferral templates, it’s possible to create deferrals directly on general journals, sales and purchase documents. I’ll show those three first of all in the general journal.

This is what happens in the video

For the example in the general journal, I would like to buy some phone and telephone, for instance, like this and they might cost 5,000 including VAT and my balance account could be my bank account if I’m paying them directly. Like this.

And in my general journal, I have a column called to deferral code. So if I want to defer this amount, for instance, for a year, I could select my 12 period straight line deferral template here, and I need to have the year opened 12 periods ahead.

So if I haven’t got that, I’ll have a mistake here saying it’s not possible to defer further than the period you have defined.

After selecting the template, it’s possible for me to select the three dots and I can actually see what will happen with these deferral amounts, and it’s also possible to change it here, so if I want for some reason to actually start in the middle of the month, I could do that and then recalculate my schedule which will defer in another way.

So it’s possible to manipulate my template directly in here also the amount if I only want to defer some of the amount and if all of the amount, it’s possible to change in here and it’s possible to change should it be days per period, Etc.

So here you can see if it’s days per period, maybe even only 10 periods and you can go on. So normally, you would of course just select the template you have made but if you want to do changes, it’s possible to do directly in here.

So this is my deferrals that I’m going to make and now I can post my journal. Before doing that, I might want to preview my posting to see what entries it’s going to make for me while creating this deferral.

And I can see how a lot of G/L entries being created and I can see my income statement account here, which is the 4000 and the 3000 is taken out of the income statement account and put into my deferral account and then on all the different periods here in my deferral period, it will transfer small amounts to that account all the time.

So it looks very nice and of course I can see my my bank account in the end under my vendor account.

So it’s possible just to post directly from here.

Let’s make another example from a purchase invoice.

I will create a new purchase invoice for our vendor and I’m just buying the telephone again to create the same example meaning that I can buy directly on a G/L account if that’s what I want.

So if I select my G/L account again, and I will buy into my phone account just like before.

Like this and of course, I would like to buy whatever telephones.

4,000 maybe without VAT and if I scroll right and I have added my deferral code to the page here, I can see the same default codes in here and after selecting the deferral code, it’s possible for me to go into my line related information and deferral schedule and in here I can see the same as coming from the G/L Journal, how the deferral schedule looks and it’s possible again to manipulate it in here before actually posting.

I need though to have some vendor invoice number if it should be possible to post this one.

I’ll just push the invoice and then make a last quick example on the sales invoice just to show that it’s also possible to do this with items.

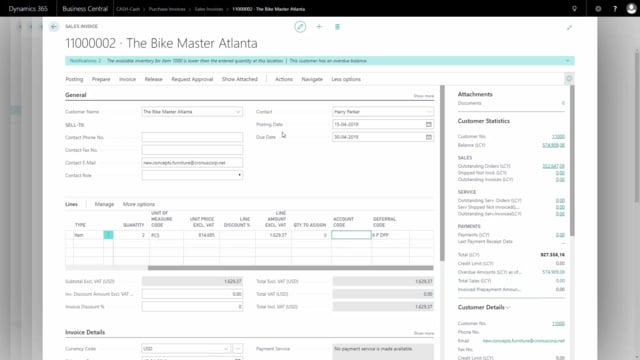

From a sales invoice… I’ll make a new sales invoice to one of my customers.

Let’s take the Bike Master in Atlanta.

In the scenario, I’ll just sell some items, some bikes, of course, that’s what we do. Two of them.

And again if I’ve added the deferral template to my sales line if possible, now I could select, for instance, the six period that I was just creating as an example and to post that. And opposite to the other example, I will just open the posted invoice to navigate it to control that my six periods look correctly.

I’ll go into my actions and navigate. I can see here my entries and I can see only 10 G/L entries because I have to be aware here there is a filter on my posting date which is the 15 of April so I can only see the April deferrals in this example.

We just hide this one so we can see the amounts.

So if I’m removing my posting date here, but keeping the document number, I can see all the other deferrals here. And of course in this example, the deferral account shouldn’t have been an expenses account, but an income account.