How do you settle VAT in Business Central?

The VAT is settled from the VAT statement where you can run a batch job that is settling your VAT, but before I’m doing that, I would like to go into my chart of accounts just to show you how my VAT looks in here, and to explain what the VAT settlement is actually doing.

This is what happens in the video

So in my chart of accounts, I know that in my solution here I have all the VAT in this section, and as you can see here my VAT payables account 94175 is now blank because I haven’t any outstanding VAT that I have calculated and not paid for and all my VATs from the period and until now is entered up here or is shown up here.

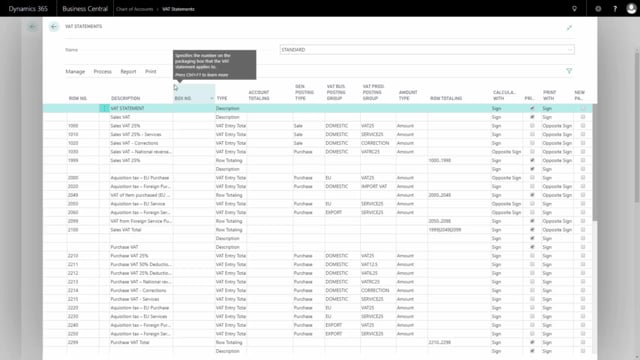

So now, I want to settle my VAT and I will go into my VAT statement. From VAT statement, I will do my VAT settlement by calculating and printing the settlement.

Normally, before doing that, I could go into my preview and see the amounts. What they would actually look like and I can also print my preview to a PDF file to save it to see what was the actual detailed figures of my VAT and I could do that from the print, menu print functionality in here.

So if I was printing it, I could print the detailed VAT statement with all the lines, whereas when I calculate my settlement in here, it will only collapse all the groups. I would just see the totals.

From my calculate and post VAT settlement, I can set up my starting date, ending date, what date to post. Many accountants like to post in the last date of the period but of course, that’s up to yourself, and I will enter the settlement account that everything will be settled into so it takes all the open VAT entries in that period and move them to my settlement account.

Normally, I could preview this before actually posting it and when I’m done with that, I could select post and it will post all my VAT into my settlement account or my payables account.

So here is my VAT settlement that I could print that and save that somewhere in an archive. If I wanted to and if we go back to my chart of accounts now, I can see here that I have settled for 135 thousand which is now in my VAT payables account.

And of course this date today will normally not be the day that I’m paying it. So now I can report to the authorities based on my settlement. I can report all my sales and purchase VAT acquisition, taxes, Etc.

And then, I will normally bill from them with the due date and would then arrive, I will go in and pay my VAT payables and I can see here the outstanding amount which is for the period that I’m in right now.

So, of course, that shouldn’t be settled right for now. When I’m actually paying my outstanding VAT payable, I will go into my general journal just to show you the complete flow.

And I’ll just select directly my VAT payables account.

And the amount that we were just settling coming from my VAT account, if I remember that, and as a balance account, I could take my bank if that’s the one I’m posting from. Here we are, and of course with all the correct dates and descriptions, Etc.

And that’s the day when I’m actually doing my physical payment on the bank for my VAT.

This is now posted and if I look back into my G\L account, now, my VAT payables is back to zero and this is my outstanding VAT for this period that I’m in right now.