How do you configure deferrals in Business Central?

Different rules are normally related to sales and purchases and it’s possible to create deferrals on purchase invoices, sales invoices, or directly in a G/L journal.

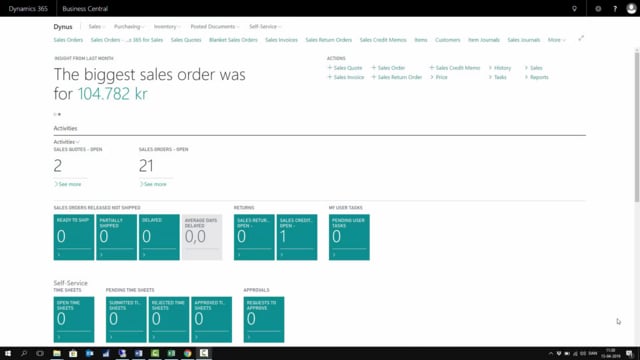

This is what happens in the video

To provide an example of a template, we have made one in our standard setup that can inspire you.

So from my menu, I will go into deferral templates and here we have a 12 straight period lines template and I can manage that one just to show how it looks.

We have named it 12 periods straight line and we have set up a deferral percentage of hundred meaning that posting with this deferral template, we would like to defer all the amount if you have set up here only 80%, you would have the 20% being posted directly and then the 80% being deferred.

you can select a calculation method. Straight line means that it will take from the starting date to the end date and calculate straight depending on each period.

So if you start in the middle of a period, it will defer some of the amount, and if it ends in the middle of a period, it will defer some of the amount and the other periods will be equals.

Equal per period mean that every period will be deferred the same. Days per period meaning that it’s deferring according to the amount of days in each period and the periods are the accounting periods, of course, and the user-defined you can set up yourself or defer manually.

The starting date on your deferral can be the posting date where you actually post whatever you’re doing the beginning or the end of period or the beginning of next period.

So if we’re in the middle of April and you do some posting and you have set up beginning of the period, it will differ by the first of April.

And on standard setup, we have created deferral account and of course, you can just create your own if you want to and it’s just the account that you accumulate all the amount into to begin with and then you differ from there, so it’s a balance account with the deferrals.

And then you set up the number of periods you want to defer and the standard text you want to insert. Insert in here. You can set percentage 4 and percentage 6 can be used for month and year which is automatically inserted.

So let’s just for the example make another deferral template here. I might want to make one called 6 periods and I want to defer all of the amount and I want to defer in days per period from the beginning of the period or maybe even from the posting date and I want to put it into the same deferral account, deferred expenses.

And of course, you could also make an account for deferral income if you are deferring income, that’s the same principle.

And in this example, I would like to set up 6 periods and as my period description, I’ll do the same as in my 12 period description.

So now, I have two different deferral templates that I can use and I can select each of them directly in the G/L journals on the sales and posting documents that I’m using.