How does the VAT posting setup affect the VAT posting in the balance accounts in Business Central?

The VAT posting setup in Business Central works, like the general posting setup, except it’s not posting into the income statement, only into the balance.

This is what happens in the video

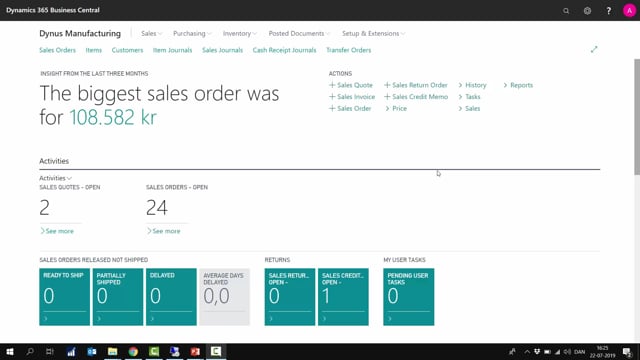

Let’s see how it looks in Business Central.

My VAT posting setup is a matrix combination of VAT business posting group and VAT product posting group.

Let’s see how that looks if we draw it.

My VAT posting setup is coming from my VAT business posting group and my VAT product posting group.

The VAT business posting group is about, who I’m selling or buying from and the VAT product posting group is about, what I’m selling or buying.

That applies to G/L accounts, resources and item, and the business posting group, to customers and vendors.

That information is transferred on to documents, and it transfers further into journals, when I do the posting because it creates journal lines, while posting.

And the VAT posting setup determines, where in the chart of accounts it should end in my sales VAT account, purchase VAT account and reverse charts VAT account.

This means, if I look at my VAT posting setup, in the database, that I used to work with.

We have the VAT business posting group being domestic, EU or export, and the VAT product posting group, being VAT 25, 12.5, 6.25 reverse charge.

We also use the VAT posting setup for some services we want to post.

This determines to whom and what the VAT should be posted by.

In real life, this is a complex matrix of, which parameter will win, when determining the final VAT percentage.

What happens, when I post to a domestic customer VAT 25, that determines, where into my chart of accounts and which accounts, the posting should affect.

Likewise, on all other combinations.

This is how my VAT posting setup works.

In other videos, we’ll explain the different columns, in Business Central and what they mean.