Playlists Manage

Log in to create a playlist or see your existing playlists.

Log inHow to use VAT business and product posting groups to do the VAT setup in Business Central?

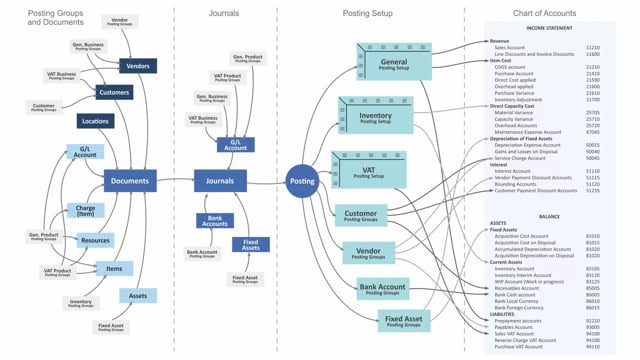

The VAT posting groups, meaning the business and product posting groups are used to determine the VAT setup in Business Central.

This is what happens in the video

This means the VAT business posting group, applies to customers and vendors, but also to G/L accounts, if you post directly in journals.

This means they set up, who we’re buying from or selling to.

The VAT product posting group is set up on things we buy or sell, like items, resources and also on G/L account for direct postings in journals, and they apply to documents in journals as well.

This means, the VAT business posting group and VAT product posting groups are flowing into the documents, further on into the journals when we do postings determined, in the VAT posting setup, which determines, where it ends in the balance account.