How does a finance department use calculated fields on customers in Business Central?

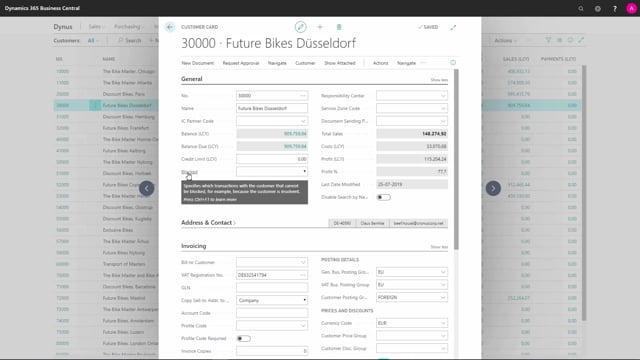

Let me show you the fields on the customer card that are relevant for the finance department.

This is what happens in the video

The first field in the general tab is the credit limit in local currency.

This specifies the maximum amount, that we can exceed the payment balance, before we get warnings in the system, when you create new orders for this customer.

If we’re having trouble collecting money from the customer, the finance department can block the customer.

We can either block the customer for shipment or invoicing, or we can block them for both.

Under invoicing, the VAT registration number specifies the customers’ VAT registration number.

The global location number is used in electronic document sending.

Also important for the finance department are the posting details.

Here, we define the general business posting group, the VAT posting group, and the customer posting group.

These are explained further in other videos.

Payments is an area that the finance department is also interested in.

In prepayments, we define if the customer should prepay a certain percentage of the orders before shipping them.

In application method, we specify how to apply payments on entries, either manually, or apply to oldest.

In payment terms code, we define when payments are due.

These are configured in the payment terms list.

In payment method code, we define how the customer should pay.

This is set up in the payment under the code table.

In reminder terms code, we define how reminders will be calculated, the due dates, the grace dates and the text that should appear.

These are set up in the reminder terms table.

If this is blank, no reminders will be created for this customer.

And finally, we have the finance charge terms code, which defines how finance charges should be calculated.

These are defined in the finance charge term code table.