Which basic fields in the General Ledger Setup should you know?

Let me run through some of the basic fields in the general ledger setup. Where to find all your parameters for your general ledger and I’ll just run through the most basic fields.

This is what happens in the video

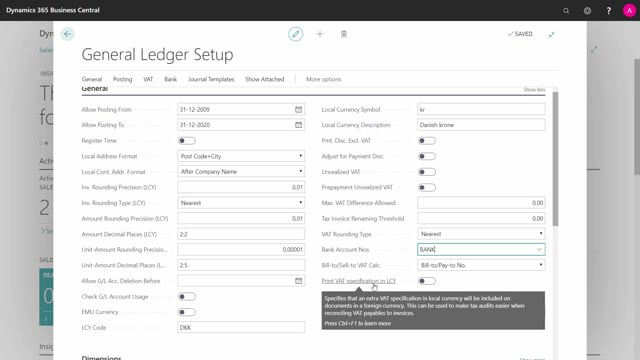

First of all, the allowed posting from and to fields to define the interval where it’s allowed to do financial postings.

And this could also be determined per user in the user setup table.

You can define whether you want to measure the time each user actually using your system and then you can define the local formats for addresses and contact addresses how you want those to be defined.

You have different selections here.

You can set up all kinds of roundings on inventory roundings.

If you want the precision and if you want it to be nearest and up and down and the amount rounding precision for local currencies and the decimal places and all those fields both here and over here on the differences make the mouse over and it’s described quite nice in here where they actually used and basically you set up if you want two characters rounding, you set it up like this.

If you want five characters of rounding, you set it up like this and this display the default amount that is shown to the user, the decimal places field.

Then you can set up the local currency code meaning the currency that your company should be defined in and the symbol for that currency and the description for that currency and you can set up standard parameters for payment discounts if you allow it to adjust payment discounts.

What do you want to do with the unrealized VAT that is calculated and you can set up a max difference allowed on the VAT.

In the text invoice remaining threshold, you can define whether an invoice should change the name to be a tax invoice if it exceeds this amount.

The VAT rounding type is defined if you wanted to run up and down or nearest to your oldest amount.

And you can set up your number series for bank accounts.

Then you can define with the checkmark here if you want the VAT specification on documents to be posted in local currencies.

If not, it will be posted in the receiver’s currencies.

And on the dimension tab, you can see the two global dimension, but you don’t define them here.

So there’s a menu here, you can see the videos on dimension, how to define which of your dimensions has to be the two global dimensions.

In your reporting section, you can set up parameters if you use account schedules in Business Central for reporting and in your application section down here, you can set up how you apply when you receive payments or you’re going to pay to your vendors, you can set up rules for that.

How the tolerances should be on those payments and how much tolerances you will accept to close the open entries.

So this is basically the most important fields in the general ledger setup.