How to invoice through the purchase journal in Business Central?

It is possible to post invoicing of purchases or acquisitions directly in the business journal, if you don’t want to use the purchase documents.

This is what happens in the video

I’ll show this in an example.

So, by entering the purchase journal, I can post directly to a vendor on one hand and on the income statement directly on the other hand.

So, the document type could be a payment, a credit memo, etc.

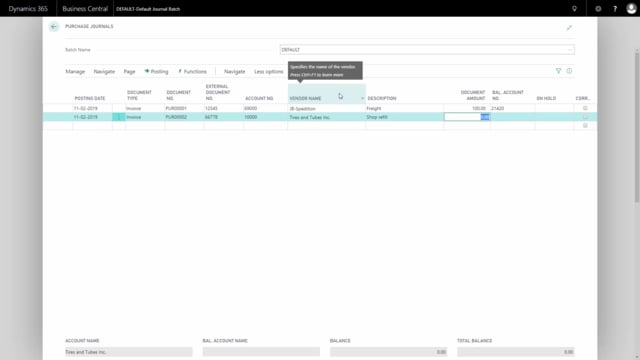

I will post an invoice, and I must enter the external document.

I enter the vendor number on this line.

It may be a freight, and I enter a description.

and my document amount, which is the amount paid to the vendor.

Normally, I wouldn’t have a document, I don’t want to post a document, if I just do it directly like this.

It could be an email.

The total balance is now -746, because this vendor is set up in euro, so it will automatically calculate in local currency, which is DKK.

And I must choose the balance account, and I select balance account 4.

Purchases from EU, it’s a German vendor, and when I select the balance account, automatically the total balance will be 0, because it has both accounts to post to.

Likewise, if I make another purchase, that has an external document number, and I may want to buy from Tires and Tubes and maybe they’re providing a shop refill of their parts that we’re selling.

It may be resources that we have bought from them.

I’d like to pay them for their work in our shops, 1,000 DKK.

I enter the balance account, in this case the domestic balance account, and the difference is purchase VAT or not, and that’s set up in the charts of accounts and relates to the balance account.

So, 100 euros and a 1000 DKK.

And I post the journal.

I would like to post the journal.

On the lines, I could also have set up dimensions, or changed the default dimension coming from the vendor.

After posting, we can see in the chart of accounts what it has created.

I can navigate on the two accounts, that I have posted into, or just find them.

The first I posted to, was my EU account.

I can see the figure here, and I can see it is posted.

Description Freight, 764 DKK, which is my local currency, and if I navigate this line, I can see all created entries.

I can see it created one VAT entry, and when I go to this one, I can see the VAT amount on the base amount and in the G/L entries, I can see the VAT amount.

Because this is an EU account, I can see the total amount.

One of these accounts is the purchase VAT, and the other is the acquisition VAT, so it equalizes itself.

If I look at the other purchase account, which was the domestic account, I can navigate into the entries, and it’s the top one, I’ll navigate on this one, and the amount was posted as 1,000 DKK.

and in the entries, I can see that it created my cost account 800 DKK, and my VAT amount 200, which equals the vendor account 1000 DKK.

So, there is a difference coming from the setup on the chart of accounts, and you can see it depending on your posting setup on the chart of accounts, both your general posting setup and your VAT posting setup that you can see on a column on the chart of accounts.