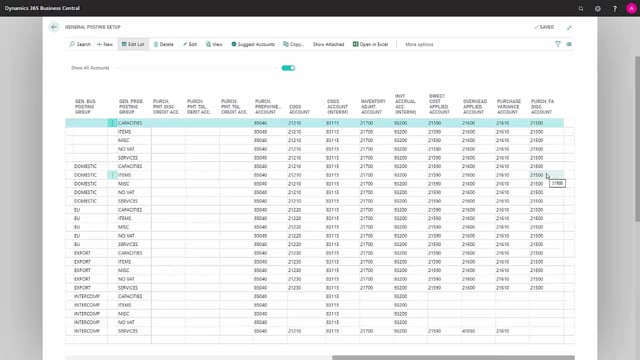

Which fields are relevant for purchase in the general posting setup in Business Central?

Let me walk through the posting setup relevant to purchasing in relation to handling of items etc.

This is what happens in the video

The first field is General Business Posting Group, which defines who we are purchasing from.

The next field is General Product Posting Group, which defines what it is we’ve bought.

So, in this case, we’ve bought Items, because we want to buy a product.

The Purchase Account field is where your purchases are posted to, in the income statement, when you make a purchase.

The next field, Purchase Credit Memo Account, is the account used, if you get a credit memo from your vendor.

The next field is Purchase Line Discount Account, which will be used if you have chosen in your purchasing setup that you want to specify your discounts in different accounts.

Then it’s the account shown here that will be used for line discounts.

The next field is Purchase Invoice Discount Account.

This is the account that will be used for invoice discounts you may receive from your vendor in connection with posting.

Here too, note that this account is only used, if you’ve opted to specify in your purchasing setup that you want discounts to be posted separately.

Purchase Payment Discount Debit Account and Purchase Payment Discount Credit Account are two accounts that are used in debit and credit respectively, when you use the combination of ‘Domestic’ and ‘Items’, and you therefore have some cash discounts that need to be posted.

The next two fields are Purchase Payment Tolerance Debit Account and Purchase Payment Tolerance Credit Account, which will be used in connection with payment tolerance when you use this combination.

The next field is Purchase Prepayment Account.

This is the account that your prepayments to your vendors will be posted to, if you have posted a prepayment invoice from your vendor.

The last field that’s relevant to purchasing is Purchase Fixed Assets Discount Account.

This field will be used if you, in your purchasing setup, have selected that you want purchase invoices divided into line discount and invoice discount, and if, in your depreciation book for your fixed assets, you’ve also opted for them to be deducted from the purchase price, so that, if you have an asset that was purchased for 100.

000, but a 20% discount was given, which is shown on your purchase line, then those 20000 will be deducted from your purchase price for the asset, and will be posted to the discount account, so that your operation, purely in discount terms, will come out zero.