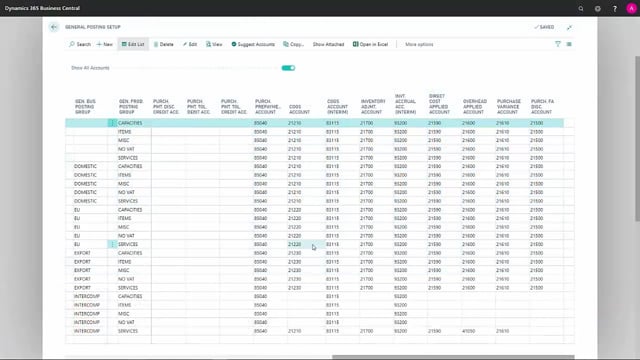

Which fields are relevant for inventory in the general posting setup in Business Central?

Let me walk through the posting setup relevant to inventory.

This is what happens in the video

The first field we come to is General Business Posting Group, which defines who we have shipped the item to, or who we have received the item from.

This field may also be blank, if it’s just an inventory movement, so there’s really nobody that’s bought or sold us this item.

The next field is General Product Posting Group, which defines the type of product we’re dealing with.

In this case, we’re starting with an item.

The next field is COGS Account, which is the item consumption account.

This is where, depending on your combination of General Business Product Posting Group and General Business Posting Group, depending on what’s actually sold, you define where to post your item consumption.

The next field is COGS Account Interim, which is an account where provisional item consumption is posted until your transactions are fully invoiced.

So, the sales invoice may not have been sent just yet, that will be done a day later; So, the provisional item consumption will be shown in this account.

The next field is Inventory Adjustment Account, which is where your inventory adjustments will be posted.

So, each time you do an appreciation or write-down of your inventory, this account will come into play according to this combination.

Inventory Accrual Account Interim is an account, where you will see an expected value for the items that you have received from vendors but that haven’t been invoiced, so that will be posted to this account.

The next field is Direct Cost Applied Account, which takes your direct costs that are applied to your items and moves them from the income statements to the inventory account.

Overhead Applied Account is an account where you will have all the overheads that have been applied to the product during production etc.

From here they will be transferred from the income statement to your inventory account on the balance sheet.

The last account is Purchase Variance Account, which is for when you use standard cost, and then this is where the variance in the purchase prices, against your standard cost, will be posted.