How is reporting of VAT vies managed in Business Central?

The VAT vies reporting is the report that displays how much you have sold to another EU company.

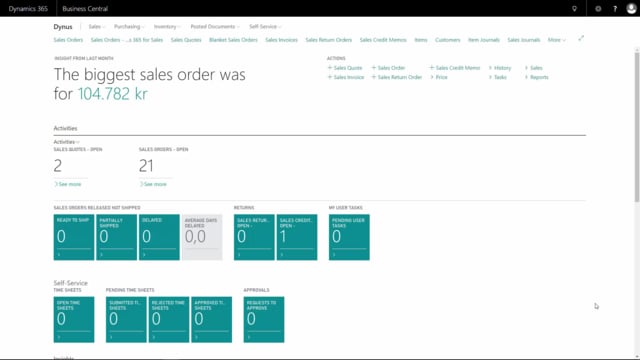

This is what happens in the video

So every company or at least in Denmark where I live has to report to the authorities how much they have sold to other EU companies. So it’s only on the sales side this has to be done and it’s only the value of the sales.

Normally, it will has to be reported per serial number for specific periods and is both physical items, services, and third-party trade that needs to be reported.

There’s a report to show you how much to report to the authorities and it’s called EC sales list and there’s actually two and the first one is used if there is no third-party reporting or third party trade.

So from the report, you select a posting date and it’s normally done per month because you have to report it in month and then you basically just preview the report and you’ll get the information that you have to tell the authorities.

And it’s have based or written only in total amounts that you have to report per VAT registration number.

Often, we see customers only having a few lines in here because they are selling to the same customers and then you just insert manually, but if you have many customers, it’s also possible to export a file with the VAT vies reporting.

So there somewhere in the menu a file you can find and then actually report this as a file to import to the authorities.

If you sell to end customers, meaning there is no VAT, they won’t have to be reported here. So it’s only business to business companies you have to report.

And normally in the country/region setup table, you will have removed the EU country in your own country otherwise, it will report VAT wise for that as well.

As you can see here. I have Denmark here in my EU country/region code and actually it shouldn’t be in here because I’m not going to report it. So I should have removed it from my country region setup.