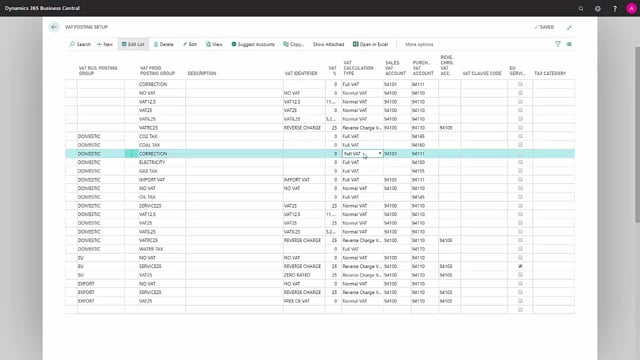

How to work with the fields in the VAT posting setup in Business Central?

Let me walk you through the various fields in the VAT posting setup.

This is what happens in the video

This way, you’ll be better prepared to handle your VAT.

The first field is VAT Business Posting Group, which is a lookup into a back-end table that, as it were, defines who it is that I’m buying from or selling to.

The next field is VAT Product Posting Group, which defines what it is I’m selling or what I’m buying.

In this case, we have selected ‘Domestic’ and ‘VAT 25’, which in Denmark is defined as the ordinary VAT.

Description is where you can Meaningfully describe what the combination of the two actually is.

In this case, we could say that it was normal domestic VAT.

VAT Identifier is a code where you can enter a particular code that you want to group different VAT setups under.

And your VAT rate can then be linked to it.

In this case, where we put VAT 25, it may be that each time we use that code, the VAT rate in this case will be 25%, or we might have one that’s called ‘No VAT’.

And in this case here, we don’t want VAT on it.

The next field is VAT percentage.

This defines how much VAT there is on your invoice so it has to be deducted in a particular way.

VAT Calculation Type is the way in which your VAT is to be calculated.

In this case, there’s one called Normal VAT.

That means it’s perfectly ordinary VAT, i.e. both purchase VAT and sales VAT will appear on your invoice.

We’ll look at how the others work later on.

The next field is Sales VAT Account.

This is where we enter the ledger account that your sales VAT is in and is posted to.

Next comes Purchase VAT Account, which is where your inbound VAT is to be posted to.

Reverse Charge Account is used in connection with reverse charge, so it isn’t usable in this case.

VAT Clause Code is where you can enter your VAT clause code.

Your government that says this is what you must put on your invoice in connection with various VAT codes.

EU Service is a code and a checkbox you can use to show that this VAT code is defined as being an EU service, and so it will appear on your reports as being an EU service.

Tax Category is a field that’s used in connection with electronic document exchange, including PayPal and so on, and so, some specific codes have to go here, if you use electronic documents.

Let’s move down and take another type of VAT code.

In this case, we choose an EU Business Posting Group and Service 25.

This time, we’ve said there is a VAT identifier called Reverse Charge, and we still have 25% VAT on it, but our VAT Calculation Type, is now showing Reverse Charge VAT, which means that there is a reverse charge on it, and each time we receive an invoice from the EU, there will be no VAT amount on it, but the system needs to know that 25% VAT must be applied.

So, in the Reverse Charge Account field, we’ll see that there is an amount that shows our acquisition VAT from the EU.

Or outside the EU.

At the same time as an entry is posted for the inbound VAT, so, this transaction comes to zero.

So, in this case it says EU Service, because this combination is an EU service provision.

The last type of VAT calculation we use, in this case, is a correction, meaning full VAT.

Here, it might be that you have various documents.

It may be import VAT.

It may be leasing VAT and so on, that you post directly to your VAT accounts.

That’s where this is useful.

Here, we’ve made two new accounts that we’ll use for our correction VAT.

So, the amount you post to these accounts will be treated as full VAT, so it will be posted directly to your VAT accounts.

The final VAT Calculation Type is Sales Tax, which is mainly used in the USA, in connection with sales tax.