How to reconcile VAT entries in Business Central?

Since it’s possible to do manual postings in Business Central, you might want to reconcile your VAT entries, to see if your amounts on the open VAT entries, equals your amount in the chart of accounts.

This is what happens in the video

And you can do that by the statement.

First of all, let’s go into the chart of accounts to find our VAT accounts.

And you can find them by searching on VAT.

And I have my sales account, my acquisition VAT and my purchase VAT.

And I would like those to fit, with my open VAT entries.

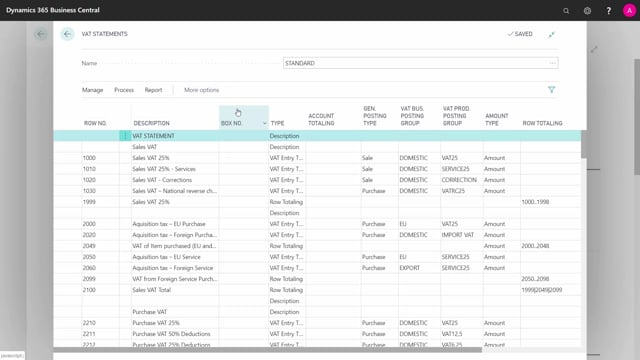

And I can reconcile those by going into my VAT statements.

And on my process tab, I can preview the statement for my VAT to see the amounts as a total with the combination of product and business posting group on my VAT.

This should be equal to my sales amount.

The acquisition tax, should equal my acquisition amount, which it does, and the purchase amount, should equal the total of my purchase amount here.

This way, I can see the total of my open VAT entries and compare them, with the quantities in the chart of accounts.