How to through the basic fields on the vendor card in Busienss Central?

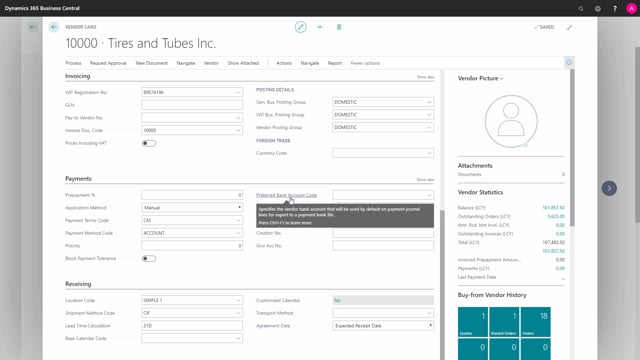

In this video, I’ll go through the basic fields on the vendor card that are relevant to the finance department. And we just have to scroll down a bit, where invoicing and payment are the taps that are relevant.

This is what happens in the video

So, first we have the VAT registration number. Yeah, that’s the vendor’s VAT registration number. Beneath the VAT registration number, there are a validation to ensure that you have the right format for what country your vendor is in.

The GLN specifies the vendor’s connection with an electronic document receiving. It could be a government department or something like that.

We have the posting groups, general business posting groups.

We have the VAT business posting group and the vendor business posting group and all these posting groups are combined to tell where on the general ledger that we have to insert all the relevant entries and we have another video about the detailed information about these posting groups.

We have the application method that specifies how to apply the payments for the vendor and that could be manual or it can also be Apply to Oldest.

Normally people use manual. It gets a better overview. The payment terms. What are the terms for the due date? In this case, it would be the current month, looks into an underlying table. We have the payment method code. How are we going to make the payment to the vendor? Is that the bank, is it a transfer, is it cash or what is it? We have the block payment tolerance, and the payment tolerance specifies if there are any tolerance for the vendors.

The tolerance you set up in the general ledger setup and you go on tolerance saying this and this amount of money is okay when they pay, so it’s not necessary to have the full amount on the invoice or in the credit memo. So if you want to block a vendor for having this tolerance, you should mark this field but payment tolerance is set up somewhere else in the system.

And the last one is the preferred bank account and that tells which bank account this vendor normally is used where you have to pay the money to. The vendor can have several bank accounts and you can look up on the bank accounts when you look at the local value.