How do you configure the VAT statement in Business Central?

The VAT statement is set up as the base for the VAT settlement. In this video, I’ll show you how we have chosen to set up the VAT statement and how it works. So this is just a basic demonstration on how you could set up the VAT statement.

This is what happens in the video

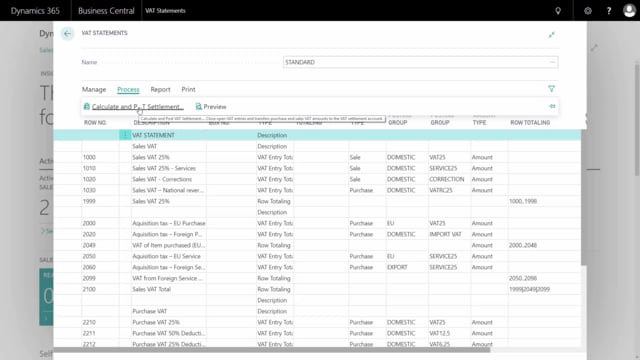

Here’s the VAT statement that we suggest and we have set it up with all the sales VAT first then the purchase VAT and in the sales VAT, we of course have included all the acquisition tax with reversed charges and likewise in the purchase VAT.

So we’ve defined columns and lines for the statement, how to settle the VAT afterwards. If we scroll down after the sales and the purchase, down here we have all the taxes, all the duties and those are all set up with– also set up with the product posting group and business posting group to be able to report that automatically because the VAT settlement is made out of the VAT entries and this is a way to actually create VAT entries for your duties and taxes as well.

In the bottom, we have the additional information or the base amount that we need to report. Some countries need to report on the base amount that the VAT is calculated upon and that’s set up down here in the end section of the VAT statement.

The VAT statement is set up with the general posting type, the VAT business posting type and the VAT business product groups and the mix of those, and in the statement line, you can see all the different combinations of the posting groups.

When you do the actual print on the statement, you will only see the collapse field which is the row totaling, whereas in the preview, you can see all the entries on different lines.

So the difference between doing from here my process tab, I can do a preview and from the report tab, I can do a statement or I can print that’s the same one.

So the difference is here that the preview tab displays all the line that I actually have in my VAT statement that I can look on, how would it look, and I can drill down into all my entries, so on my combination of domestic and VAT 25, I can drill into my VAT entries and see what is going to be settled when I calculate it and here I can see all the open VAT entries.

So the VAT statement preview is actually displaying per line what is going to happen.

Whereas the– If we go in here, whereas the VAT statement is the report that I can print and normally I would print that to a PDF or to the screen when performing my reporting.

So if I set a date here, ending date for as last year and I preview this and this is the same report I would have if I select print and this will actually display what I need to report to the authorities and this is collapsed per line. So now I will only have– Well, sorry about that. So now, I will only have one line with sales VAT 25%.

So this is the things that I actually need to report and I have all my base amount in the bottom that I can report.

This is the VAT statement that I can print and save.

So both the VAT statement up here and the preview doesn’t do any posting. It doesn’t reset your VAT introduced entries. That is done with the calculated and post VAT settlement and that will be showed in another video how to actually reset your finance with those VAT.