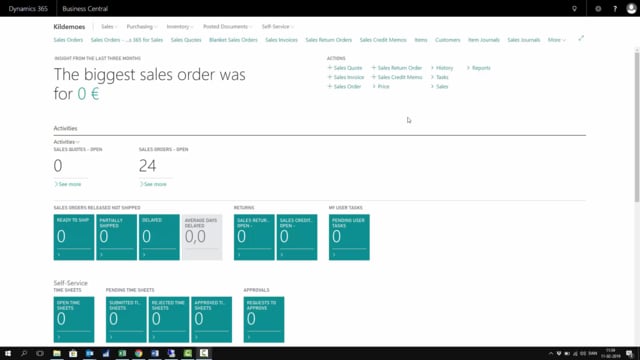

How to post sales directly into a sales journal in Business Central?

In Business Central, it’s possible to post sales directly on a sales journal, if you don’t want to create sales documents like invoices, So if you just receive money, that you want to post to an account, it’s possible in the sales Journal.

This is what happens in the video

Let’s say, we have a shop, where we are servicing and repairing bikes, and we have existing customers coming with their bikes and submit them for repair, and they pay in cash.

Let’s see, how that works in the sales journal.

First, I’ll enter my sales journal and I can enter document type invoice, if it’s actually a payment from a customer with an account number, I can select the customer number, and maybe I have different existing customers coming into my shop, and they pay in cash in the shop.

I enter in the description, what they are paying for, so this could be repair on bikes, and they pay in cash, and if I wait with the balance account, and I enter the document amount, And let’s say the document amount is 100, and I know this customer is in Euro.

The total balance is 745, which is in Danish currency, and now, when I enter my balance account, It could be the Sales EU, because this is an EU customer.

I can see that the total balance goes to 0, because now I have both accounts to post into.

If I post on another customer, it could be one with Danish currency.

So, there’s no currency code.

And therefore, I will post into another account which is the domestic sales account, which is set up for normal VAT handling in Denmark.

I’ll enter my amount.

And it may be 500 DKK.

And I can post the journal.