Which fields are avaiable in the currency card inside Business Central?

Let me run through what you should bear in mind when setting up currency codes in Business Central.

This is what happens in the video

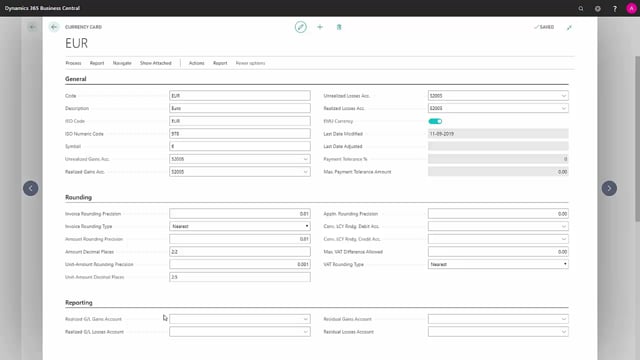

In this case, we’ve started with an already completed currency card, and I’ll now take you through the different fields on the card.

The first field that’s relevant for creating a currency is the Code field, where you enter an appropriate code for your currency.

In this case, we’ve entered EUR for Euro.

The next field is Description, where you put a suitable description of your currency code.

The next field is ISO code, which is defined in ISO 4217, and in this case it’s the same code as our currency code, EUR.

And along with the next field, ISO numeric code, which is 978 for this currency, we’ve now typed that in.

The next field, Symbol, is where you can enter whatever symbol may be appropriate to the currency in question.

You can also just opt to write whatever text is appropriate.

So, if it was Danish kroner, we’d have put DKK.

The next field, Unrealized Gains Account, is an account where all the unrealized currency gains will be posted in connection with an exchange rate adjustment.

The next field is Realized Gains Account, which is where all your realized exchange rate gains will be posted in connection with exchange rate adjustment, or when you’ve actually realised an exchange rate gain related to the entry.

Unrealized Losses Account is where your unrealised losses, in connection with exchange rate adjustments, will be posted.

Realised Losses Account is where all realized losses will be posted.

The EMU Currency field is a field that defines whether this currency code is a former EMU currency code, so you’d put a tick here.

This might be, if you had some old Deutschmarks lying in reserves.

Then you could enter that it has been transferred to an EMU currency.

The next field, Last Date Modified, is when the currency card was last edited.

And Last Day Adjusted is when the exchange rates were last value-adjusted.

Payment Tolerance Percentage is what percentage tolerance you want when payment is made in this currency.

In this case, we’ve got zero.

And Max Payment Tolerance Amount is how big a numerical value the tolerance can be in this currency.

If you want to change these two, you have to use a feature on the currency code card.

Now, we’ll move on to Rounding.

The first field we come to here is Invoice Rounding Precision, while defines by how much your invoices are to be rounded, when you’re using the Euro currency code.

In this case, we’ve said we’ll round to whole cents.

Our Invoice Rounding Type is to ‘Nearest’.

We can also opt to round ‘Up’ or ‘Down’.

Amount Rounding Precision is For the individual amounts on your lines on purchase invoices, on sales invoices etc, how they are to be rounded.

In this case, we’ve again opted for them to be simply rounded to whole cents.

Amount Decimal Places determines how many decimal places are visible.

The figure on the left means that there are always at least two decimal places visible, and the figure on the right determines how many decimal places can be displayed altogether.

In this case, it’s just 2 and 2.

So, there can never be more than 2 decimal places.

Unit Amount Rounding Precision is how the individual cost prices or sales prices on the individual units can be.

How much they are to be rounded by.

For this, we’ve put that it’s just under one cent.

Unit Amount Decimal Places defines how many decimal places there can be in a relevant field.

Here, we’ve opted to say that there must always be at least 2 decimal places.

But there can be up to 5 decimal places in the field.

Applied Rounding Precision is a field that determines what rounding factor there must be, if you settle your payments in different currencies.

Perhaps the invoice is issued in Euros, but you got paid in Danish kroner, so, there’s a rounding factor that will ensure that the whole sum is now settled without having a little balance left over.

Max VAT Difference Allowed is how big a VAT difference is allowed when we’re using this currency.

VAT Rounding Type is what your rounding types are to be.

In this case, we have rounding to ‘Nearest’; we can also have rounding ‘Up’ or ‘Down’.

Under Reporting, we find things that are useful, if you have an extra reporting currency, and so, these accounts will be used, if that is set up in your Finance setup.

The first field is how your realized exchange rate gains in your reporting currency will be posted to your income statement when there are exchange rate adjustments.

The same applies to the next field, Realised G/L Losses Account, which is where all your losses will be posted to in connection with your reporting currency.

Residual Gains Account and Residual Losses Account are two rounding accounts that are used if you usually post in relation to the general journal.

There may be some rounding differences, and it will only be in the reporting currency that these two get used.